Florida is a state that is particularly prone to flooding. From hurricanes to tropical storms, heavy rainfalls, and rising sea levels, the state is constantly at risk of water damage and flooding. That’s why it is important for Florida residents to understand the importance of flood insurance and how it can help protect their property and belongings in the event of a flood.

Why Is Flood Insurance Important in Florida?

Flood insurance is important in Florida because of the risk of flooding in the state. Hurricanes, tropical storms, flooding from heavy rainfalls, and rising sea levels all make the state especially vulnerable to flooding. Without flood insurance, homeowners could be left with thousands of dollars in damages and losses, which could be devastating financially.

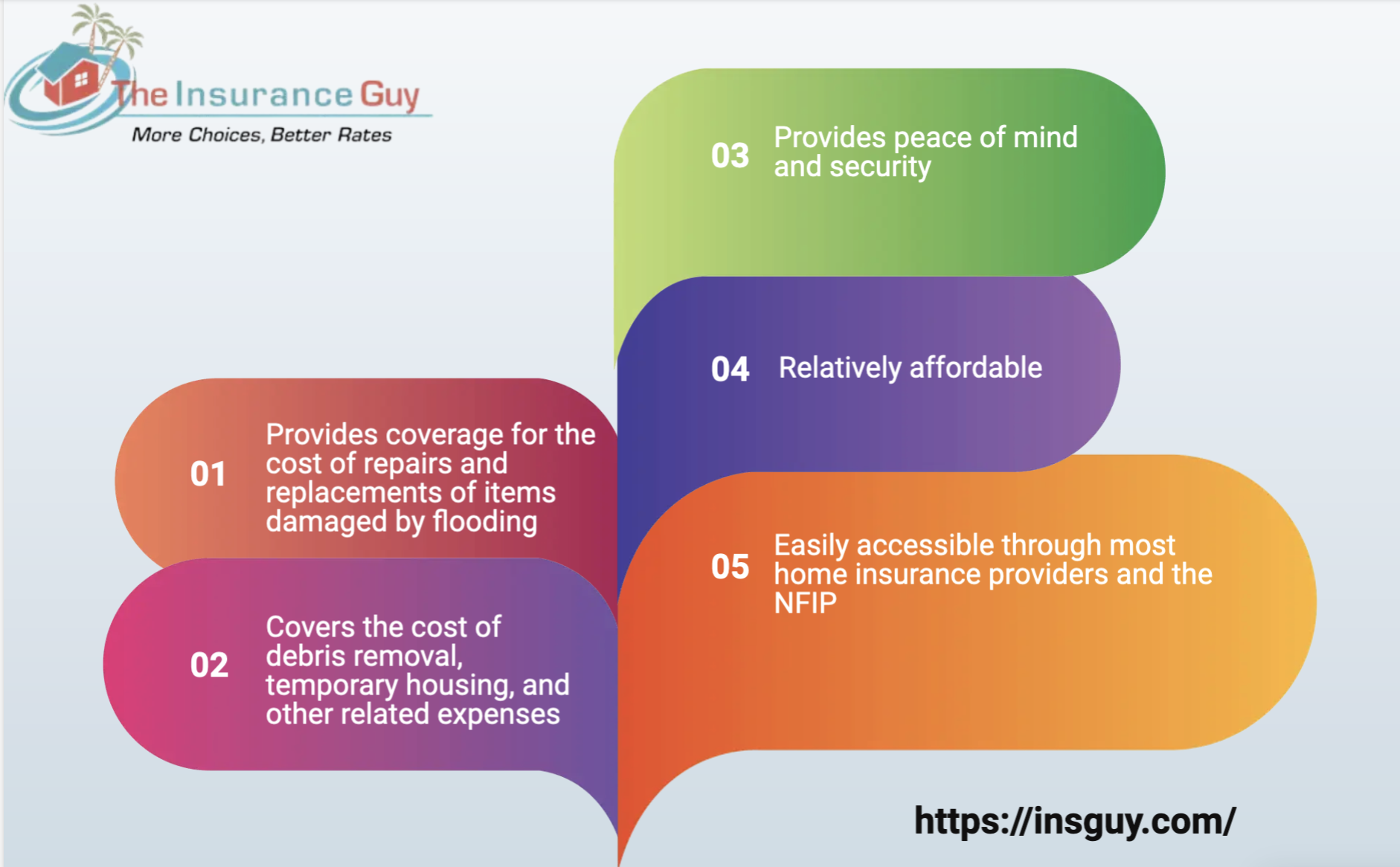

Flood insurance helps to protect homeowners from this financial burden by providing coverage for the cost of repairs and replacements of items damaged by flooding. It can also help to pay for the removal of debris, the cost of temporary housing, and other related expenses.

What Does Flood Insurance Cover?

Flood insurance can provide coverage for the cost of repairs and replacements of items damaged by flooding, such as furniture, appliances, electronics, and other belongings. It can also cover the cost of debris removal, temporary housing, and other related expenses.

In addition, some policies may also provide coverage for the structure of the home, such as the foundation, walls, floors, and other structural elements that are damaged by flooding. This coverage may also include the cost of repairs or replacements of items like plumbing, heating, and air conditioning systems.

What Are the Benefits of Flood Insurance?

- The primary benefit of flood insurance is that it can help to protect homeowners from the financial burden of repairing or replacing items damaged by flooding. It can also provide coverage for the cost of debris removal, temporary housing, and other related expenses, which can help to reduce the financial impact of flooding.

- Another benefit of flood insurance is that it can provide peace of mind. Knowing that your home and belongings are protected in the event of a flood can help to provide a sense of security and relief.

How Much Does Flood Insurance Cost in Florida?

The cost of flood insurance in Florida will vary depending on factors such as the location of the property, the type of property (e.g. single-family home, condo, etc.), and the coverage amount. Generally, flood insurance policies are relatively affordable, with rates typically ranging from a few hundred dollars to several thousand dollars per year.

Who Should Buy Flood Insurance in Florida?

Flood insurance is an important protection for all homeowners in Florida, regardless of whether they live in a high-risk flood zone or not. Even if your property is not located in a designated high-risk flood zone, you may still be at risk of flooding due to heavy rainfalls and rising sea levels.

How Can I Get Flood Insurance in Florida?

The easiest way to get flood insurance in Florida is to contact your home insurance provider. Most home insurance providers offer flood insurance policies, and they can help you find the right coverage for your needs.

You can also get flood insurance through the National Flood Insurance Program (NFIP). The NFIP is a federal program that provides flood insurance to homeowners, renters, and business owners in participating communities.

Learn Why Flood Insurance Is Crucial in Florida

Flood insurance is an essential protection for homeowners in Florida. From hurricanes to tropical storms, heavy rainfalls, and rising sea levels, the state is constantly at risk of water damage and flooding. Without flood insurance, homeowners could be left with thousands of dollars in damages and losses, which could be devastating financially.

Flood insurance helps to protect homeowners from this financial burden by providing coverage for the cost of repairs and replacements of items damaged by flooding. It can also help to pay for the removal of debris, the cost of temporary housing, and other related expenses.

Key Features and Benefits of Flood Insurance

Overall, flood insurance is an essential coverage for homeowners in Florida. It can help to protect against the financial burden of repairing or replacing items damaged by flooding and provide

peace of mind in the face of potential water damage. Whether you live in a high-risk flood zone or not, the risk of flooding in Florida is significant, and having flood insurance is a wise decision.

To obtain flood insurance in Florida, you can start by reaching out to your home insurance provider. Most providers offer flood insurance policies and can assist you in finding the right coverage for your specific needs. Alternatively, you can explore the National Flood Insurance Program (NFIP), a federal program that offers flood insurance to homeowners, renters, and business owners in participating communities.

The cost of flood insurance in Florida varies based on several factors, including the property’s location, type, and desired coverage amount. Generally, flood insurance policies are relatively affordable, with rates typically ranging from a few hundred dollars to several thousand dollars per year.

By purchasing flood insurance, you gain several benefits. Firstly, it provides coverage for the cost of repairing or replacing items damaged by flooding, including furniture, appliances, electronics, and other belongings. Additionally, flood insurance can cover expenses such as debris removal, temporary housing, and other related costs. This coverage extends to the structure of your home, including its foundation, walls, floors, and other structural elements, as well as essential systems like plumbing, heating, and air conditioning.

One of the significant advantages of flood insurance is the peace of mind it offers. Knowing that your home and belongings are protected in the event of a flood can alleviate worries and provide a sense of security. Moreover, the financial protection it provides helps mitigate the potential devastating impact of flooding on your finances.

It’s crucial to highlight that flood insurance is necessary for all homeowners in Florida, regardless of whether their property is located in a high-risk flood zone. Even if you reside in an area not designated as high-risk, factors like heavy rainfalls and rising sea levels can still expose your property to the risk of flooding.

In conclusion, flood insurance is an essential coverage for homeowners in Florida due to the state’s vulnerability to water damage and flooding. It protects against the financial burden of repairing or replacing items affected by flooding, covers debris removal and temporary housing costs, and offers peace of mind. With its affordability and accessibility through home insurance providers and the NFIP, acquiring flood insurance is a prudent step towards safeguarding your property and belongings from potential water-related disasters.