In the sunshine state of Florida, picturesque beaches, lush landscapes, and a vibrant lifestyle often overshadow a lurking threat: flooding. With its extensive coastline and susceptibility to hurricanes, Florida is one of the most flood-prone states in the United States. As a homeowner or property owner in this beautiful state, understanding the cost of flood insurance is vital. In this blog post, brought to you by The Insurance Guy, we’ll delve into the factors that influence flood insurance quotes in Florida and what you can expect when protecting your property from this natural disaster.

Understanding Flood Insurance in Florida

Before we delve into the cost of flood insurance, let’s have a brief overview of what flood insurance is and why it’s crucial in Florida. Flood insurance is a specialized insurance policy designed to cover property damage caused by flooding, typically not covered by standard homeowner’s insurance.

In Florida, the need for flood insurance is driven by its geography and climate. The state’s low-lying coastal areas, high rainfall, and frequent hurricanes make it particularly susceptible to flooding. Hence, obtaining a flood insurance quote in Florida is not just a prudent decision but often a requirement for mortgage lenders, especially if your property lies in a designated flood zone.

Factors Influencing Flood Insurance Quotes in Florida

When you approach The Insurance Guy or any other insurance provider in Florida for a flood insurance quote, several factors come into play, affecting the cost of your policy. Let’s explore these factors:

- Flood Zone: Florida has various flood zones, each with a different level of flood risk. If your property is in a high-risk flood zone (such as Zone A or Zone V), your flood insurance quote will be higher compared to properties in low-risk zones.

- Elevation: The elevation of your property in relation to the base flood elevation (BFE) can significantly impact your premium. Higher elevations typically result in lower premiums.

- Building Structure: The type of structure you want to insure matters. Different rates apply to single-family homes, condos, apartments, and commercial properties.

- Coverage Amount: The amount of coverage you choose will naturally affect your premium. The more coverage you need, the higher your quote will be.

- Deductible: Similar to other insurance policies, a higher deductible will lower your premium, but you’ll pay more out of pocket in the event of a flood-related claim.

- Year of Construction: The age of your property can impact your premium. Newer structures often have lower premiums due to better construction standards.

- Previous Claims: If your property has a history of flood-related claims, it may result in higher premiums.

- Location: Proximity to water bodies, like rivers, lakes, or the coast, can influence your flood insurance rate.

The Insurance Guy: Your Trusted Partner

Now that you understand the factors influencing flood insurance quotes in Florida, you might wonder how to get an accurate estimate for your property. This is where The Insurance Guy steps in as your trusted partner.

At The Insurance Guy, we are committed to providing you with the best possible flood insurance solutions tailored to your needs and budget. We work with multiple insurance carriers to ensure you receive competitive quotes. Our experienced agents can help you navigate the complexities of flood insurance, guiding you through the process of obtaining quotes and selecting the right coverage for your property.

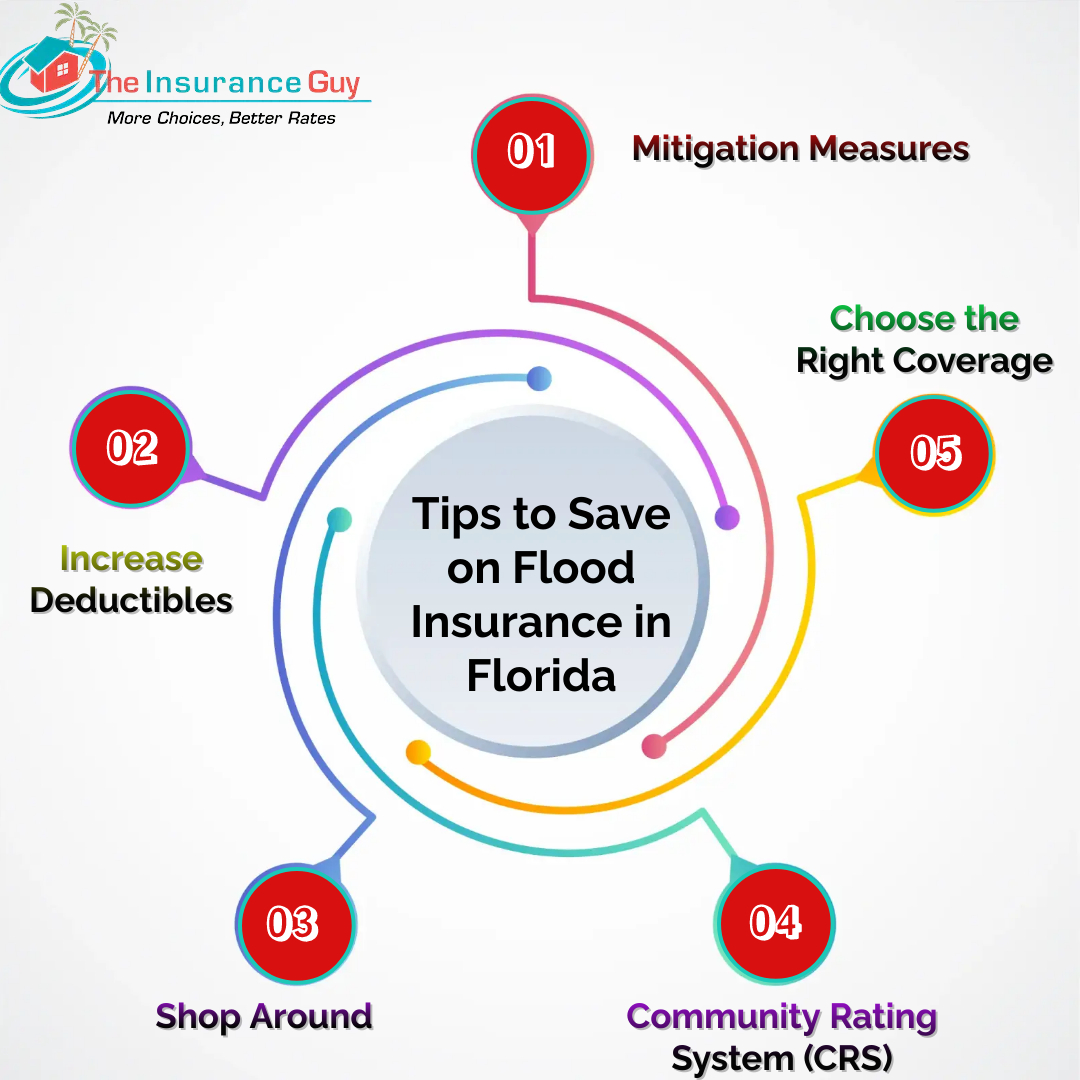

Tips to Save on Flood Insurance in Florida

While flood insurance in Florida is essential, there are ways to manage the cost effectively:

- Mitigation Measures: Consider investing in flood mitigation measures such as elevating your property or installing flood vents. These steps can help reduce your premiums.

- Increase Deductibles: If you can afford a higher out-of-pocket expense in case of a flood, opt for a higher deductible to lower your premium.

- Shop Around: Don’t settle for the first quote you receive. Work with an insurance broker like The Insurance Guy to compare quotes from different carriers and find the best deal.

- Community Rating System (CRS): In some communities, participating in the CRS can lead to discounts on flood insurance premiums by implementing floodplain management practices.

- Choose the Right Coverage: Ensure you are not over-insured. Select coverage that adequately protects your property without unnecessary expenses.

Conclusion

In Florida, the cost of flood insurance can vary significantly based on a multitude of factors. Understanding these factors and working with experienced professionals like The Insurance Guy can help you secure the right coverage at a competitive price. Remember that while flood insurance may seem like an additional expense, it offers invaluable protection for your home and peace of mind during Florida’s unpredictable weather events. Don’t wait until it’s too late—get your flood insurance quote in Florida today and safeguard your property from the unexpected. The Insurance Guy is here to assist you every step of the way.