Almost everyone who lives in Florida has had firsthand experience with the floods at least once in their life. The damage that these dense water streams cause can be massive. Even if you haven’t been affected much by it, you must have the proper insurance to cover your losses. If you don’t buy one and the floods hit your area, the losses can push you back by several years financially. Even if you don’t own a house and live on the property of someone who has flood insurance, you must buy flood insurance to secure your personal stuff.

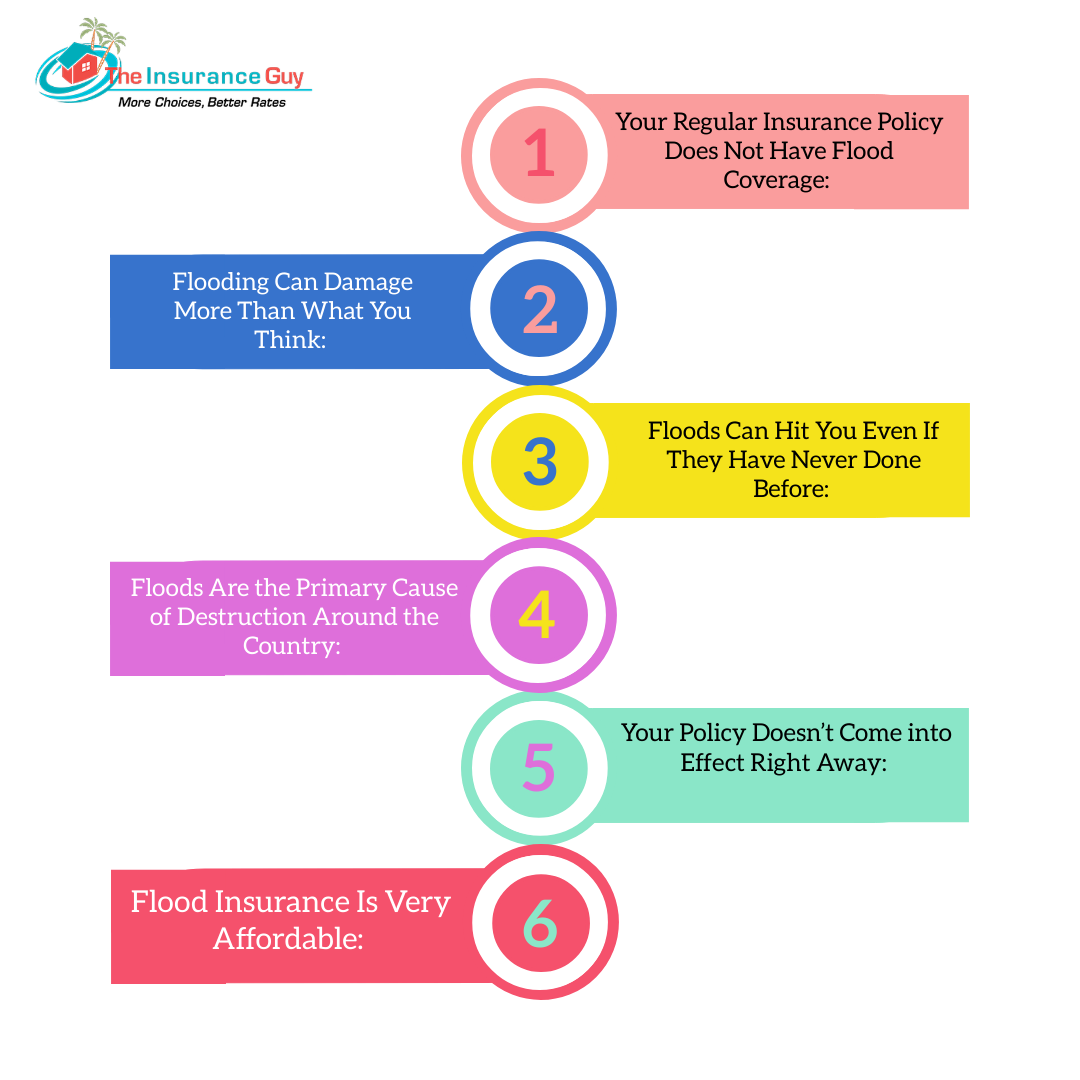

If you are still wondering, here are the top six reasons you should buy a flood insurance policy:

-

Your Regular Insurance Policy Does Not Have Flood Coverage:

Many people believe that their comprehensive insurance policy covers just about everything they own. However, damages caused due to catastrophic events like floods do not come under such plans. You have to buy a flood insurance policy separately. You can get up to $350,000 coverage under the federal National Flood Insurance Program (NFIP). If you need more coverage, you can buy it from a private insurance company with attractive inclusions.

-

Flooding Can Damage More Than What You Think:

An inch of the flood can cause thousands of dollars’ worth of damages. Imagine what floods higher than that can do to you. Add to it the value attached to those damaged items; you just cannot recover them that easy.

-

Floods Can Hit You Even If They Have Never Done Before:

The scary thing about floods is that they can hit anywhere. Coastal states are more vulnerable to flooding, which is why it is a wise decision to get the protection of flood insurance before things go out of hand.

-

Floods Are the Primary Cause of Destruction Around the Country:

Hurricanes and floods are the most common natural disasters in the United States, more so in the state of Florida. This is why most of the state area comes under the federal-sponsored NFIP, which provides financial protection to everyone living within it.

-

Your Policy Doesn’t Come into Effect Right Away:

If you come under the NFIP zone, you will need to buy the coverage at least 30 days before you can avail its benefit. The private flood insurance also kicks in after a few days, which can vary depending upon the insurance provider.

-

Flood Insurance Is Very Affordable:

Contrary to what most people believe, flood insurance isn’t that costly. For very little money, you can secure the protection of $350,000 for damages to your home and other personal items. If you buy a private insurance policy, the coverage can be even more extensive.

Are you still thinking about a flood insurance policy? Flood insurance is something that needs little thinking, especially if you live in Florida. This small decision can give you complete peace of mind.

For more details, contact your nearest Tampa Bay flood insurance company and ask for a free quote today.